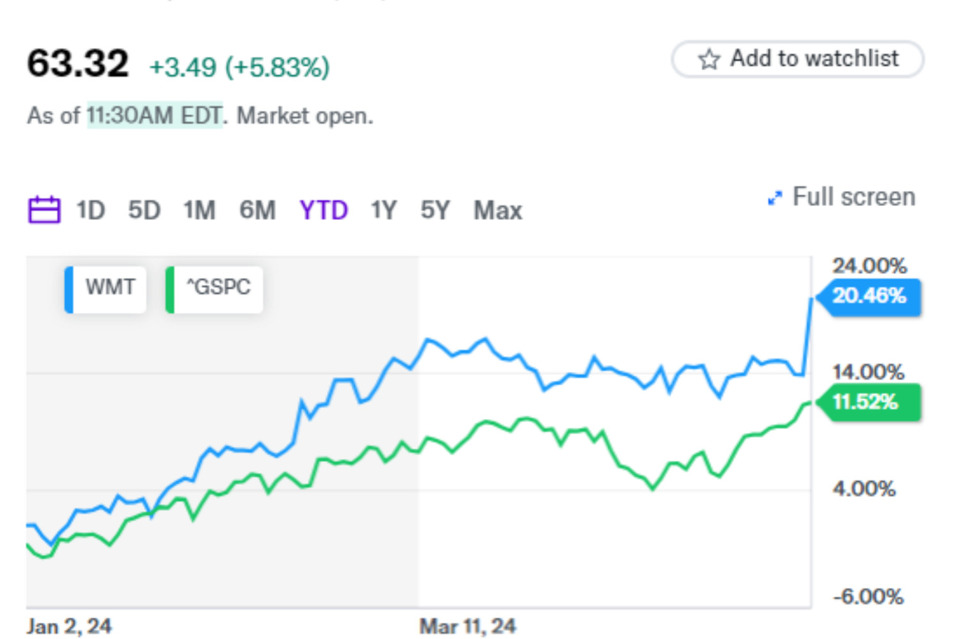

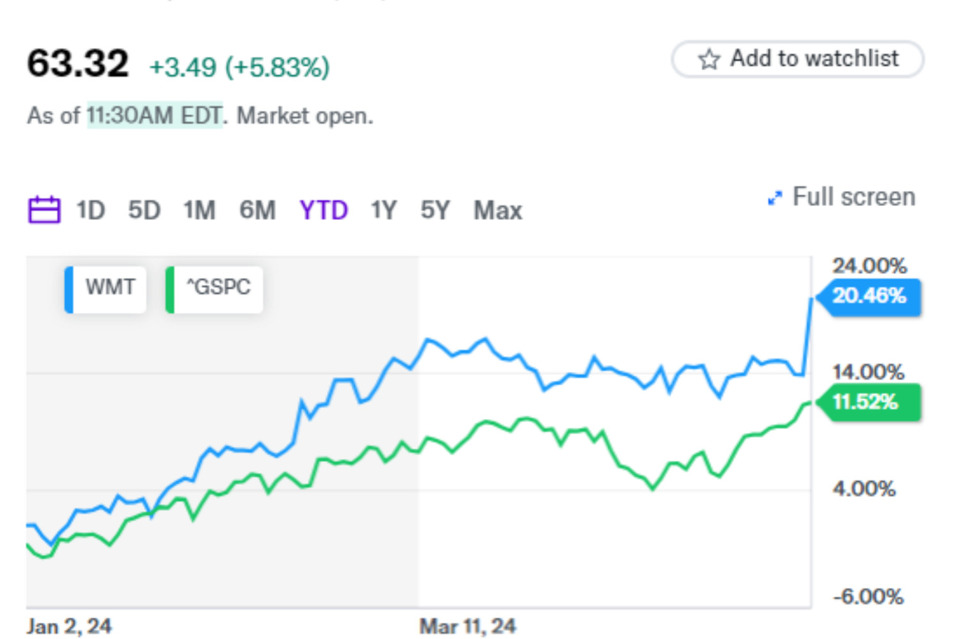

Walmart stock surged after the retail giant surpassed market expectations with its fiscal 2025 Q1 earnings report. The robust performance drove shares up by about 6% in early trading Thursday, highlighting the company's resilience and adaptability in the ever-evolving retail landscape.

CEO Doug McMillon hailed the quarter as "great," emphasizing the team's commitment to delivering value and convenience to customers. The stellar results included revenue of $161.51 billion, exceeding analyst estimates, and adjusted earnings per share of $0.60, demonstrating Walmart's strong financial footing.

The Report

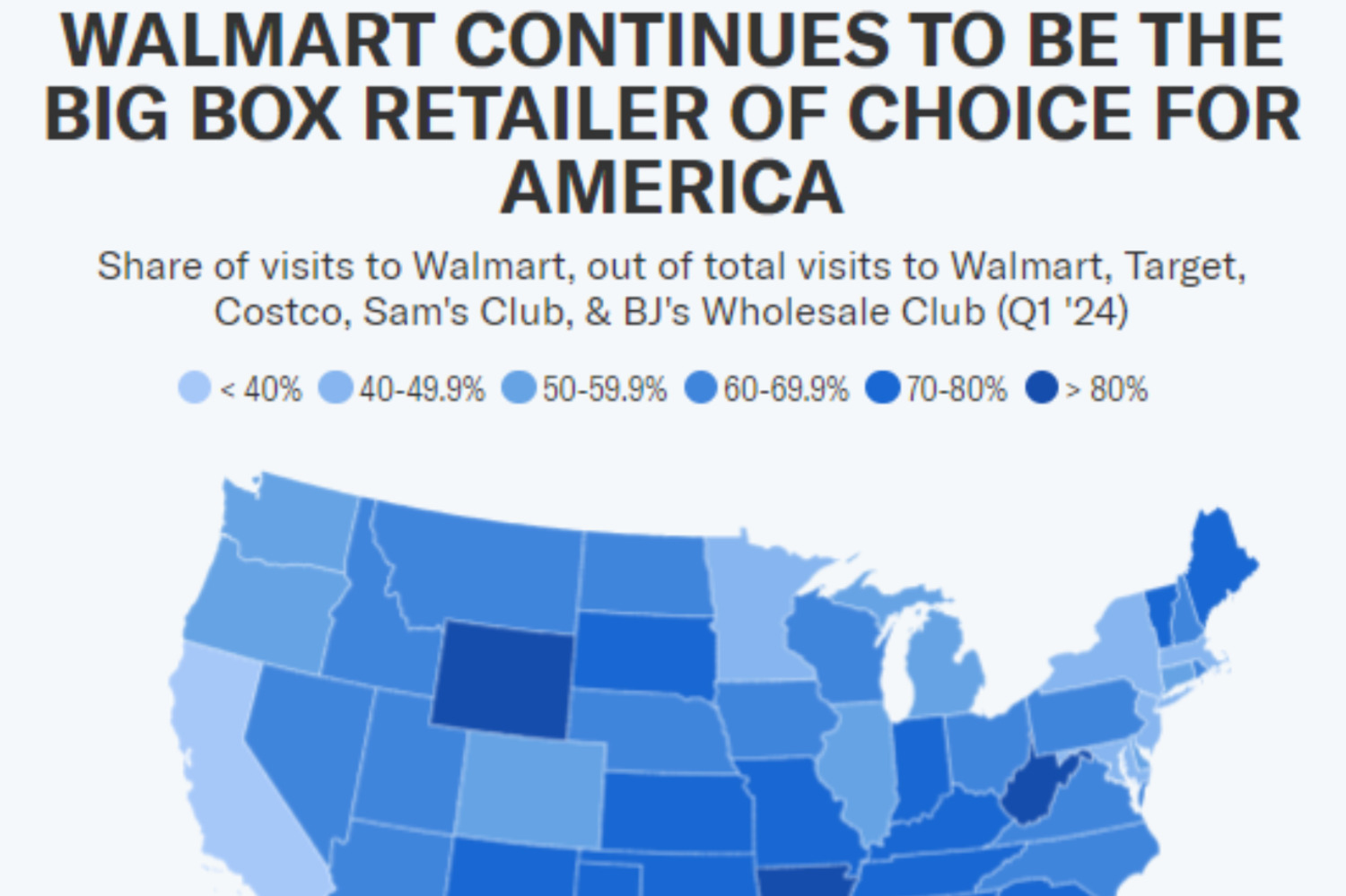

The retail giant reported a 3.9% increase in total US same-store sales, fueled by growth across its various segments. Notably, Sam's Club experienced a 4.4% surge in same-store sales, driven by increased demand for grocery items. Walmart's e-commerce sales soared by 21%, reflecting the company's successful integration of online and offline channels to meet customer needs.

Despite facing macroeconomic challenges, Walmart remains well-positioned for future growth. The company's strategic initiatives, including investments in technology and store enhancements, continue to drive customer engagement and loyalty.

Analysts have expressed optimism about Walmart's prospects, with some recommending the stock as a top pick. The company's strong performance in the first quarter and optimistic outlook for the fiscal year underscore its resilience and ability to navigate changing market dynamics.

Walmart's commitment to innovation and customer-centricity positions it for continued success in the competitive retail landscape. As the company continues to invest in its omnichannel capabilities and enhance its product offerings, it remains a key player in the retail industry.

Overall, Walmart's impressive earnings beat and positive outlook signal a bright future for the retail giant, reaffirming its status as a market leader and investor favorite. With a solid foundation and strategic vision, Walmart is poised to drive long-term value for shareholders and deliver exceptional experiences for customers.